UPSC

PIB

Decade of Empowerment: Insights into PM Mudra Yojana

Last Updated

8th April, 2025

Date Published

8th April, 2025

Share This Post With Someone

.webp?2025-04-08T12:29:04.503Z)

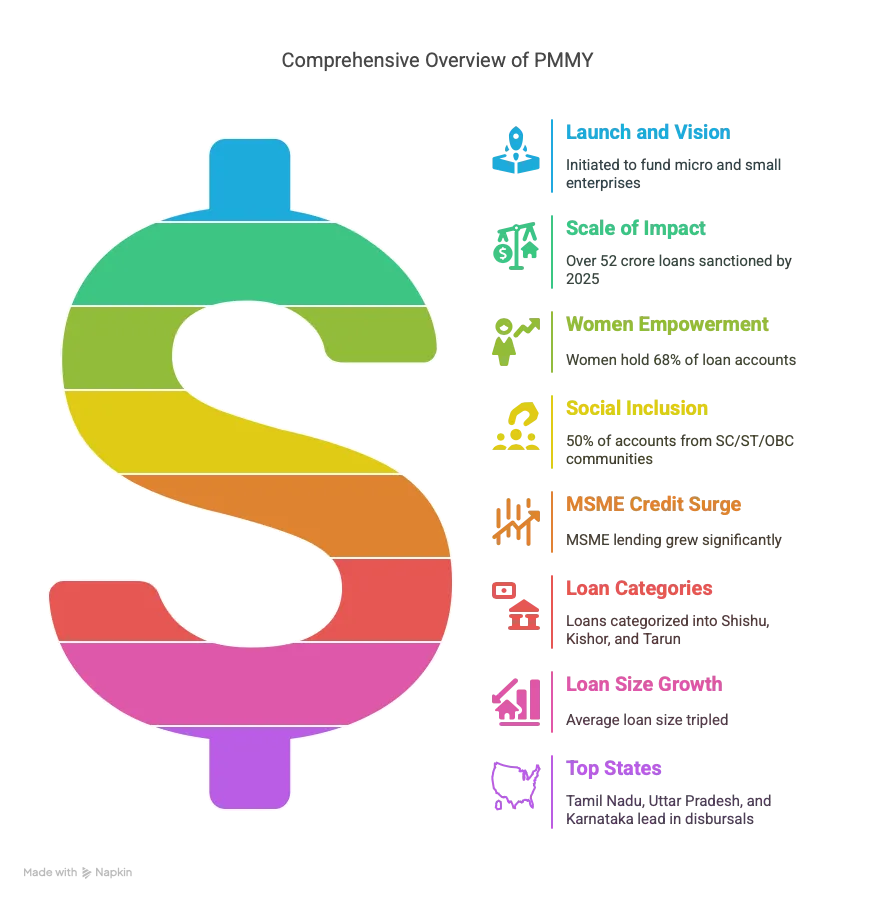

- Launch and Vision: Initiated on April 8, 2015, the Pradhan Mantri Mudra Yojana (PMMY) aims to fund unfunded micro and small enterprises, fostering grassroots entrepreneurship with collateral-free loans up to ₹20 lakh.

- Scale of Impact: Over 52 crore loans worth ₹32.61 lakh crore have been sanctioned by 2025, transforming job seekers into job creators across rural and urban India.

- Women Empowerment: Women hold 68% of loan accounts, with disbursements per woman rising at a 13% CAGR (FY16-FY25), boosting women-led MSMEs and employment.

- Social Inclusion: 50% of accounts belong to SC/ST/OBC communities, and 11% to minorities, breaking credit barriers and promoting equitable economic participation.

- MSME Credit Surge: MSME lending grew from ₹8.51 lakh crore (FY14) to ₹27.25 lakh crore (FY24), projected to hit ₹30 lakh crore in FY25, enhancing the business ecosystem.

- Loan Categories: Shishu (up to ₹50,000), Kishor (₹50,000-₹5 lakh), and Tarun (₹5 lakh-₹10 lakh) loans show a shift, with Kishor’s share rising from 5.9% (FY16) to 44.7% (FY25).

- Loan Size Growth: Average loan size tripled from ₹38,000 (FY16) to ₹1.02 lakh (FY25), reflecting scaling businesses and economic depth.

- Top States: Tamil Nadu (₹3.23 lakh crore), Uttar Pradesh (₹3.14 lakh crore), and Karnataka (₹3.02 lakh crore) lead in disbursals as of February 28, 2025.

- International Praise: The IMF recognizes PMMY for expanding financial access, especially for women, and supporting over 2.8 million women-owned MSMEs by 2023.

- Economic Role: By addressing microenterprises’ challenges like finance access and skill gaps, PMMY strengthens India’s self-reliant economy and job creation.

Glossary

- Collateral-Free: Loans without requiring assets as security.

- CAGR: Compound Annual Growth Rate, measuring yearly growth over a period.

- MSME: Micro, Small, and Medium Enterprises, key to India’s economy.

- Grassroots: Initiatives starting at the local or community level.

- Financial Inclusion: Ensuring access to financial services for all, especially marginalized groups.