UPSC

PIB

Fiscal Health Index 2025: Decoding State-Level Economic Stability

Last Updated

3rd April, 2025

Date Published

3rd April, 2025

Share This Post With Someone

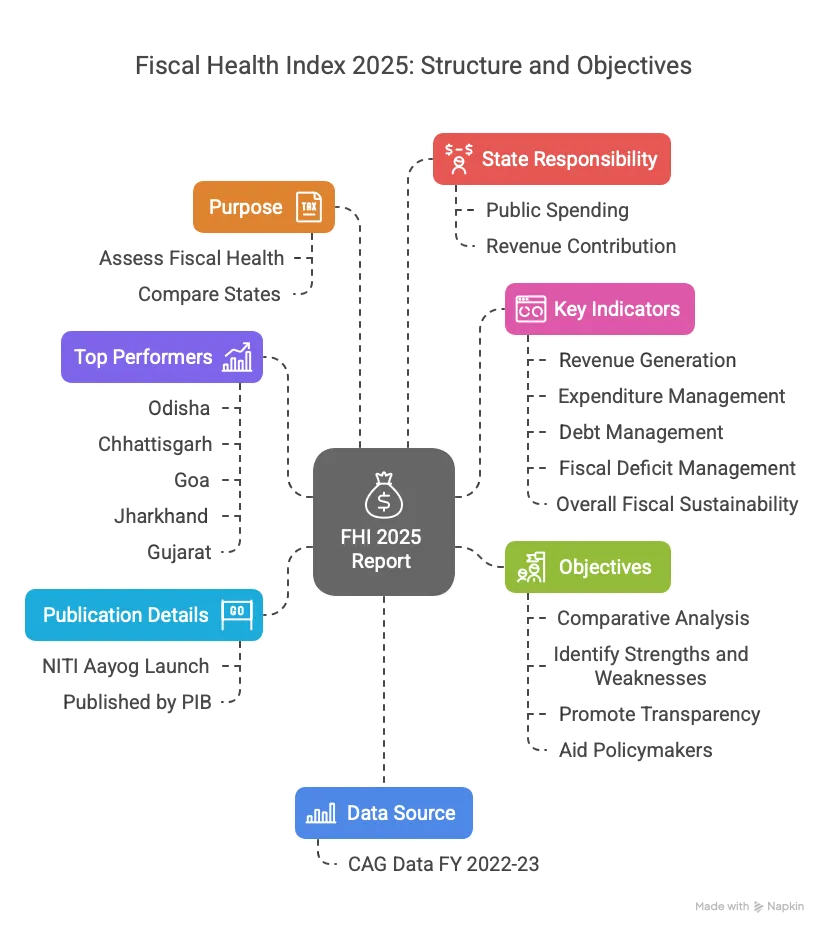

Released on April 2, 2025, by the Press Information Bureau under the Ministry of Information and Broadcasting, the Fiscal Health Index (FHI) 2025, an initiative by NITI Aayog, evaluates the fiscal performance of 18 major Indian states for the financial year 2022-23. This report provides a data-driven analysis of state economies, emphasizing fiscal resilience and sustainability, and is a vital resource for understanding governance, economic policy, and interstate disparities in India.

Key Points

- Publication Details: Launched by NITI Aayog, the FHI 2025 report was published on April 2, 2025, by the Research Unit of the Press Information Bureau, Government of India.

- Purpose: Aims to assess and compare the fiscal health of 18 major states contributing significantly to India’s GDP, demography, public expenditure, revenues, and fiscal stability.

- Top Performers: Odisha leads with an FHI score of 67.8, followed by Chhattisgarh (55.2), Goa (53.6), Jharkhand (51.6), and Gujarat (50.5).

- Data Source: Utilizes data from the Comptroller and Auditor General of India (CAG) for FY 2022-23 to create a composite FHI score.

- State Responsibility: States account for two-thirds of public spending and one-third of total revenue, making their fiscal health critical for national economic stability.

- Objectives:

- Provide comparative fiscal health analysis using standardized metrics.

- Identify strengths and weaknesses in fiscal management.

- Promote transparency, accountability, and prudent fiscal practices.

- Aid policymakers in enhancing fiscal sustainability and resilience.

- Key Indicators:

- Revenue Generation and Mobilization: Evaluates own revenue receipts, tax buoyancy, and non-tax revenue (e.g., Odisha’s mining premiums, Chhattisgarh’s coal auctions).

- Expenditure Management: Assesses efficiency, capital expenditure prioritization, and fiscal discipline.

- Debt Management: Analyzes debt-to-GSDP ratios, interest burdens, and debt sustainability.

- Fiscal Deficit Management: Measures fiscal deficit as a percentage of GSDP and compliance with statutory limits.

- Overall Fiscal Sustainability: Combines revenue, expenditure, deficit, and debt metrics for a holistic view.

- State Rankings and Scores:

- Odisha: 67.8 (Rank 1) – Excels in Debt Index (99.0), Debt Sustainability (64.0), with strong revenue mobilization (69.9).

- Chhattisgarh: 55.2 (Rank 2) – High Debt Index (79.6), moderate sustainability (29.0).

- Goa: 53.6 (Rank 3) – Leads in Revenue Mobilization (87.1), lower sustainability (25.2).

- Jharkhand: 51.6 (Rank 4) – Strong fiscal prudence (62.4).

- Gujarat: 50.5 (Rank 5) – Balanced performance across indicators.

- Maharashtra (50.3, Rank 6), Uttar Pradesh (45.9, Rank 7), Telangana (43.6, Rank 8), Madhya Pradesh (42.2, Rank 9), Karnataka (40.8, Rank 10).

- Lower ranks: Tamil Nadu (29.2, Rank 11), Rajasthan (28.6, Rank 12), Bihar (27.8, Rank 13), Haryana (27.4, Rank 14), Kerala (25.4, Rank 15), West Bengal (21.8, Rank 16), Andhra Pradesh (20.9, Rank 17), Punjab (38.2, Rank 18).

- Key Findings:

- Odisha’s strengths: Low fiscal deficits, robust debt profile, high capital outlay-to-GSDP ratio.

- Non-tax revenue: Odisha, Jharkhand, Goa, and Chhattisgarh average 21% of total revenue from sources like mining and coal.

- Capital expenditure: Odisha, Goa, Madhya Pradesh, Karnataka, and Uttar Pradesh allocate 27% of developmental expenditure to capital projects; West Bengal, Andhra Pradesh, Punjab, and Rajasthan allocate only 10%.

- Struggling states: Punjab, Andhra Pradesh, West Bengal, and Kerala face high fiscal deficits, poor debt sustainability, and low expenditure quality.

- Debt concerns: West Bengal and Punjab show rising debt-to-GSDP ratios, threatening long-term stability.

- Categories of States:

- Achievers: Odisha (1), Chhattisgarh (2), Goa (3), Jharkhand (4), Gujarat (5).

- Front Runners: Maharashtra (6), Uttar Pradesh (7), Telangana (8), Madhya Pradesh (9), Karnataka (10).

- Performers: Tamil Nadu (11), Rajasthan (12), Bihar (13), Haryana (14).

- Aspirational: Kerala (15), West Bengal (16), Andhra Pradesh (17), Punjab (18).

- Conclusion: The FHI 2025 emphasizes the need for continuous fiscal monitoring, efficient revenue generation, debt control, and adherence to deficit targets. It has been shared with all States/UTs to encourage sustainable fiscal practices tailored to their economies.

Glossary

- Fiscal Health Index (FHI): A composite metric assessing states’ fiscal performance across multiple indicators.

- NITI Aayog: Government think tank driving the FHI initiative for policy reform.

- CAG: Comptroller and Auditor General of India, source of fiscal data for the report.

- Debt-to-GSDP Ratio: Measure of a state’s debt relative to its Gross State Domestic Product.

- Revenue Mobilization: Ability of states to generate own revenue through taxes and non-tax sources.

- Fiscal Deficit: Gap between a state’s expenditure and revenue, expressed as a percentage of GSDP.

- Capital Expenditure: Spending on infrastructure and development projects, key to long-term growth.

- Debt Sustainability: Capacity to manage debt without compromising fiscal stability.

- Tax Buoyancy: Responsiveness of tax revenue to economic growth.

- Gross State Domestic Product (GSDP): Total economic output of a state, a benchmark for fiscal metrics.