IndusInd Bank Derivative Crisis: An Economic Insight

Last Updated

20th March, 2025

Date Published

20th March, 2025

Share This Post With Someone

Context:

This analysis details the revelation of Rs 2,100 crore in derivative losses by IndusInd Bank, announced on March 10, 2025, and its implications for the banking sector.

- Derivative Losses Unveiled: On March 10, 2025, IndusInd Bank disclosed Rs 2,100 crore in derivative losses, a 2.35% hit to its net worth (Rs 65,102 crore as of December 2024), stemming from forex derivative transactions.

- Nature of Derivatives: These were forex swaps used by the treasury to hedge foreign currency deposits/borrowings into rupees, aimed at mitigating exchange rate risks over 5-7 years prior to April 2024.

- Accounting Discrepancy: Losses from these derivatives were not recognized in Net Interest Income (NII), while treasury gains were booked in the Profit & Loss (P&L) statement, masking the financial impact until an internal review.

- RBI Regulation Trigger: New RBI rules (September 2023) banned internal hedging trades from April 1, 2024, forcing the bank to unwind old derivative positions, exposing accumulated losses of Rs 2,100 crore (pre-tax).

- Loss Accumulation: The bank failed to mark-to-market (MTM) losses daily, allowing them to build over time, breaching accounting norms despite a centralized tracking system.

- Management Response: An external agency was appointed to validate findings, with losses to be absorbed in Q4 FY25 or Q1 FY26, potentially pushing the bank into a quarterly loss.

- Regulatory Oversight: RBI was aware of the issue, approving CEO Sumant Kathpalia’s reappointment for only one year (March 24, 2025–March 23, 2026), signaling governance concerns.

- Market Impact: Derivative disclosure led to a 23% share price drop (from Rs 900.60 to Rs 655 by March 11), reviving to Rs 692 by March 19, reflecting investor unease over derivative mismanagement.

- Broader Implications: Raises questions on derivative risk management in banking, with RBI now probing other banks’ forex derivative exposures to prevent systemic risks.

Overview of Derivatives with Respect to Economy

Derivatives are financial instruments central to modern economies, including India. They derive their value from underlying assets like stocks, bonds, commodities, currencies, or indices, and are widely used for risk management, speculation, and arbitrage. Understanding derivatives is crucial for grasping financial markets, banking stability, and regulatory frameworks.

- Definition: Derivatives are contracts between two parties whose value depends on an underlying asset (e.g., equity, forex, interest rates) without owning it, traded either over-the-counter (OTC) or on exchanges.

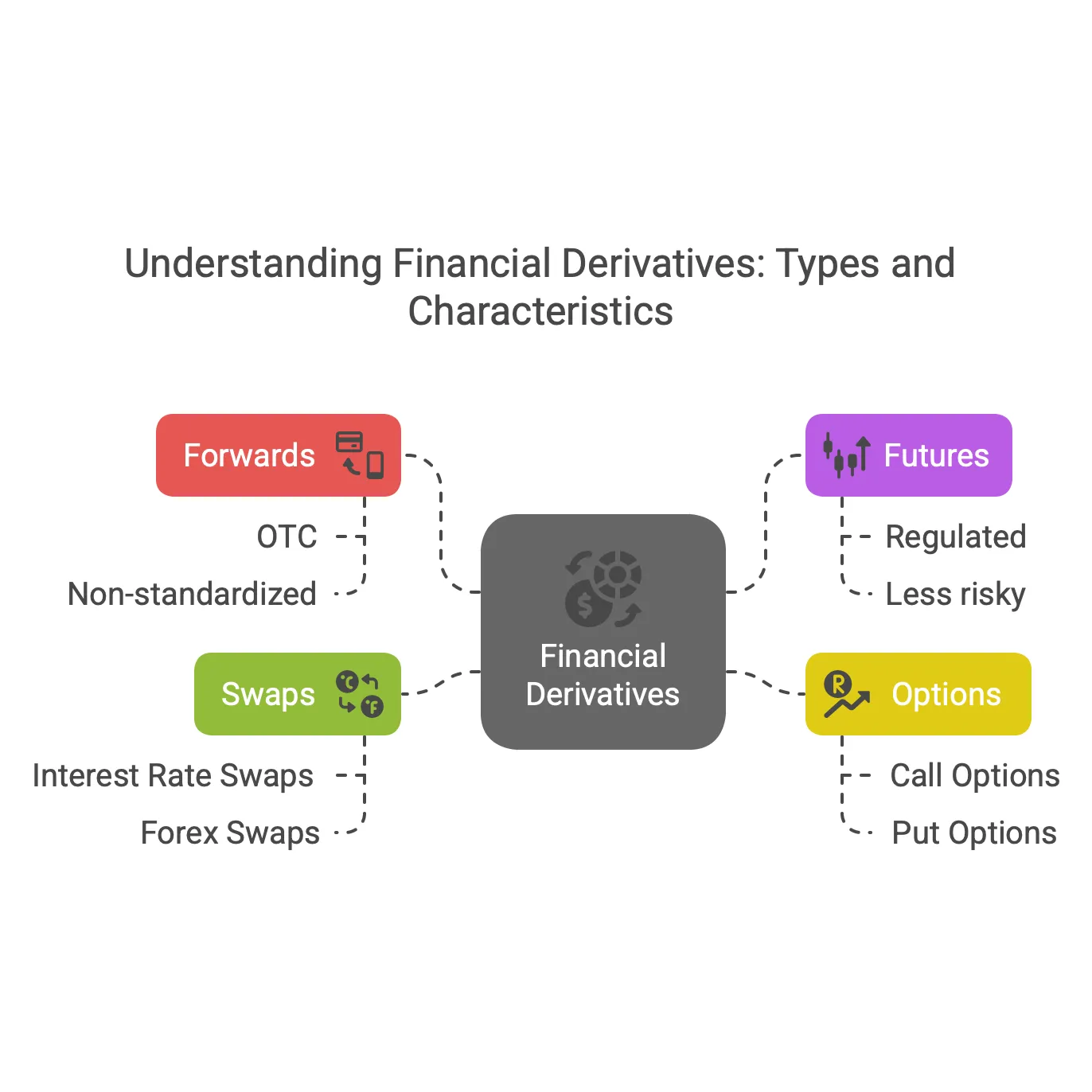

- Types:

- Forwards: Customized agreements to buy/sell an asset at a future date at a set price; OTC, non-standardized (e.g., forex forwards in IndusInd Bank case).

- Futures: Standardized contracts traded on exchanges (e.g., NSE) to buy/sell at a future date; regulated and less risky than forwards.

- Options: Contracts giving the right (not obligation) to buy (call) or sell (put) an asset at a strike price before/by expiry; used for hedging or speculation.

- Swaps: Agreements to exchange cash flows (e.g., interest rate swaps, forex swaps) over time; common in treasury operations.

- Economic Functions:

- Hedging: Protects against price volatility (e.g., farmers locking crop prices, banks managing forex risks).

- Speculation: Allows betting on price movements for profit (e.g., traders predicting rupee depreciation).

- Arbitrage: Exploits price differences across markets for risk-free gains.

- Indian Context:

- Regulated by RBI and SEBI; traded on NSE, BSE, and MCX.

- Forex derivatives (e.g., USD-INR contracts) manage exchange rate risks amid India’s $650 billion+ forex reserves (March 2025).

- Commodity derivatives (e.g., gold, oil) stabilize prices in a volatile import-dependent economy.

- Significance for Economy:

- Financial Stability: Facilitates risk management in banks (e.g., IndusInd’s forex swaps), but mismanagement can lead to crises (Rs 2,100 crore loss, March 2025).

- Capital Markets: Enhances liquidity and depth (e.g., Nifty futures trading volume exceeds cash markets).

- Trade and Investment: Supports export-import firms by hedging currency fluctuations (India’s exports: $437 billion, FY24).

- Risks:

- Leverage: High exposure with low initial investment amplifies losses (e.g., IndusInd’s untracked losses).

- Complexity: Misunderstanding (e.g., not marking-to-market) can destabilize institutions.

- Systemic Risk: Interconnected defaults can ripple through the economy (2008 global crisis reference).

- Regulation in India:

- RBI: Oversees forex and interest rate derivatives; tightened rules in 2023 (e.g., banned internal hedging from April 2024).

- SEBI: Regulates equity and commodity derivatives; ensures transparency via exchanges.

- FEMA 1999: Governs cross-border derivative transactions.

Why It Matters:

Derivatives reflect India’s integration into global finance, balancing opportunities (risk mitigation, market efficiency) with challenges (governance lapses, volatility). They link macroeconomic stability, monetary policy, and sectoral growth (agriculture, banking), making them a critical aspect of economic analysis and policy-making.

Link To The Original Article – https://indianexpress.com/article/explained/explained-economics/indusind-bank-derivative-losses-9894425/