UPSC

PIB

Plastic Parks: Catalysing Sustainable Industrial Growth

Last Updated

11th April, 2025

Date Published

11th April, 2025

Share This Post With Someone

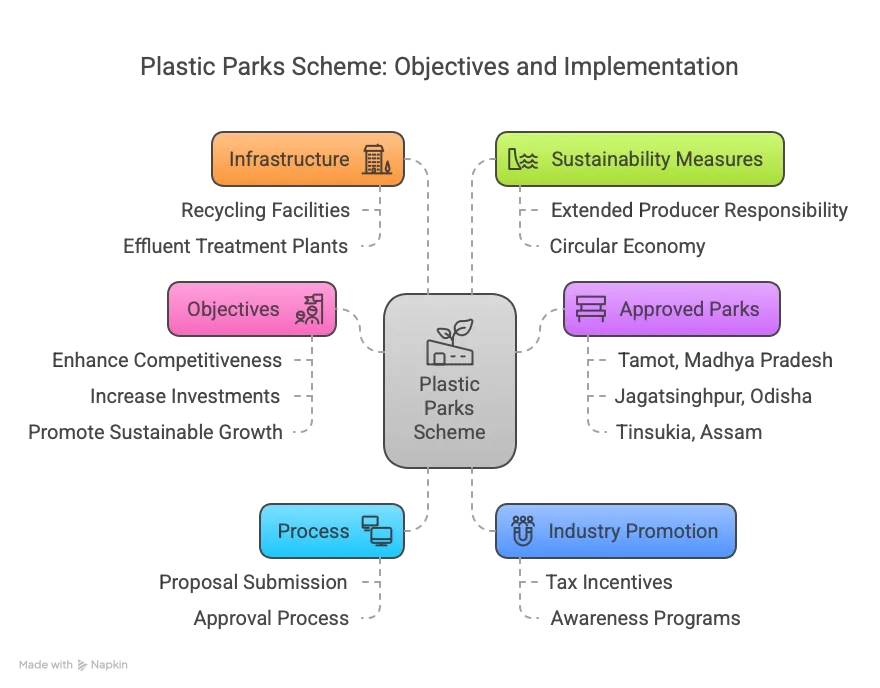

- Scheme Overview: The Plastic Parks Scheme, under the Ministry of Chemicals and Fertilizers, promotes cluster-based development of plastic processing industries to boost investment, production, exports, and employment.

- Funding: Central government provides up to 50% of project cost, capped at ₹40 crore per park.

- Objectives:

- Enhance competitiveness and value addition in plastic processing via modern research.

- Increase investments and exports through quality infrastructure.

- Promote sustainable growth via waste management and recycling.

- Leverage economies of scale through cluster development.

- Approved Parks (10):

- Tamot, Madhya Pradesh (2013): ₹108 crore, ₹36 crore released.

- Jagatsinghpur, Odisha (2013): ₹106.78 crore, ₹36 crore released.

- Tinsukia, Assam (2014): ₹93.65 crore, ₹35.73 crore released.

- Bilaua, Madhya Pradesh (2018): ₹68.72 crore, ₹30.92 crore released.

- Deoghar, Jharkhand (2018): ₹67.33 crore, ₹30.30 crore released.

- Tiruvallur, Tamil Nadu (2019): ₹216.92 crore, ₹22 crore released.

- Sitarganj, Uttarakhand (2020): ₹67.73 crore, ₹30.51 crore released.

- Raipur, Chhattisgarh (2021): ₹42.09 crore, ₹11.57 crore released.

- Ganjimutt, Karnataka (2022): ₹62.77 crore, ₹6.28 crore released.

- Gorakhpur, Uttar Pradesh (2022): ₹69.58 crore, ₹19.13 crore released.

- Process:

- States submit preliminary proposals with location and cost estimates.

- Scheme Steering Committee grants in-principle approval.

- Detailed Project Report (DPR) submitted and evaluated for final approval.

- Special Purpose Vehicles (SPVs) or State Industrial Development Corporations manage implementation.

- Industry Promotion: States offer competitive plots, tax incentives, and awareness programs to attract private investment.

- Infrastructure: Includes effluent treatment plants, solid/hazardous waste management, recycling facilities, and incinerators.

- Export Growth: India’s plastic exports grew from $8.2 million (2014) to $27 million (2022), ranking 12th globally.

- Industry Challenges: Fragmented sector with small/medium units lacking capacity to fully exploit export potential.

- Centres of Excellence (CoE) (13):

- Focus on sustainable polymers, advanced materials, bio-engineered systems, and wastewater management.

- Locations include Pune, Chennai, Bhubaneswar, Delhi, Guwahati, Roorkee, Hyderabad, Thane.

- Approvals from 2011 to 2022.

- Skilling: Central Institute of Petrochemical Engineering and Technology offers short- and long-term courses in plastic processing.

- Sustainability Measures:

- Extended Producer Responsibility (EPR): Mandates recycling, reuse, and recycled content in packaging; bans certain single-use plastics.

- Hazardous Waste Management Rules: Ensures proper disposal and resource recovery.

- Circular Economy: Promotes recycling and biodegradable alternatives via exhibitions and technology showcases.

- International Compliance: Engages with WTO, UNEP, and ISO for global sustainability standards.

Glossary:

- Plastic Park: Industrial zone for plastic processing to boost production, exports, and sustainability.

- Cluster Development: Concentrating industries for resource optimization and economies of scale.

- Extended Producer Responsibility (EPR): Policy holding producers accountable for plastic waste management.

- Circular Economy: System promoting reuse, recycling, and sustainable resource use.

- Centre of Excellence (CoE): Research hub for innovation in plastics and polymers.