UPSC

Exam Nugget

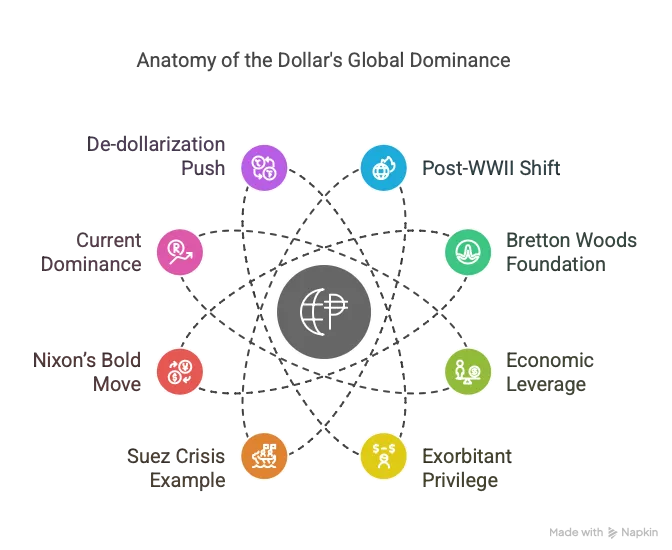

The Dollar’s Global Currency Dominance Post World War II

Last Updated

10th April, 2025

Date Published

10th April, 2025

Share This Post With Someone

- Post-WWII Shift: After World War II, the U.S. emerged as a global superpower, replacing Britain, whose pound sterling weakened due to war debts and imperial decline.

- Bretton Woods Foundation: In 1944, the Bretton Woods Agreement pegged currencies to the U.S. dollar, convertible to gold at $35 per ounce, establishing it as the global reserve currency.

- Economic Leverage: The dollar’s status allows the U.S. to finance trade deficits by printing money, lending abroad, and maintaining low borrowing costs via foreign bond purchases.

- Exorbitant Privilege: Coined by France’s Finance Minister in the 1960s, this term reflects the U.S.’s ability to borrow cheaply and wield economic influence without immediate fiscal strain.

- Suez Crisis Example: In 1956, the U.S. forced Britain and France to abandon the Suez invasion by refusing to support the pound, showcasing the dollar’s geopolitical clout.

- Nixon’s Bold Move: In 1971, President Nixon ended dollar-gold convertibility, shifting to a floating exchange rate system, yet the dollar retained dominance due to U.S. economic strength.

- Current Dominance: Today, the dollar accounts for 59% of global foreign exchange reserves, reinforcing U.S. financial and sanction power despite rising debt concerns.

- De-dollarization Push: BRICS nations and others are diversifying currencies and exploring alternatives, challenging the dollar’s supremacy amid geopolitical tensions.

- Trump’s Stance: President-elect Trump (as of 2025) has threatened tariffs on BRICS countries to defend the dollar’s status, highlighting its strategic importance.

- Future Uncertainty: Rising U.S. debt ($35 trillion) and competitors like the euro and yuan raise questions about the dollar’s long-term reign, impacting global economic stability.

Glossary

- Bretton Woods Agreement: A 1944 pact establishing the dollar as the world’s reserve currency, tied to gold.

- Reserve Currency: A currency held by central banks for international trade and stability, like the U.S. dollar.

- Exorbitant Privilege: The economic and political advantages the U.S. gains from the dollar’s global status.

- Floating Exchange Rate: A system where currency value fluctuates based on market forces, adopted post-1971.

- BRICS: An economic bloc (Brazil, Russia, India, China, South Africa) pushing for reduced dollar reliance.

Link To The Original Article – https://indianexpress.com/article/research/an-exorbitant-privilege-how-thr-dollar-emerged-as-the-global-reserve-currency-9707777/