UPSC

Indian Express Concise

US Stock Market Correction: Global Economic Implications

Last Updated

6th April, 2025

Date Published

6th April, 2025

Share This Post With Someone

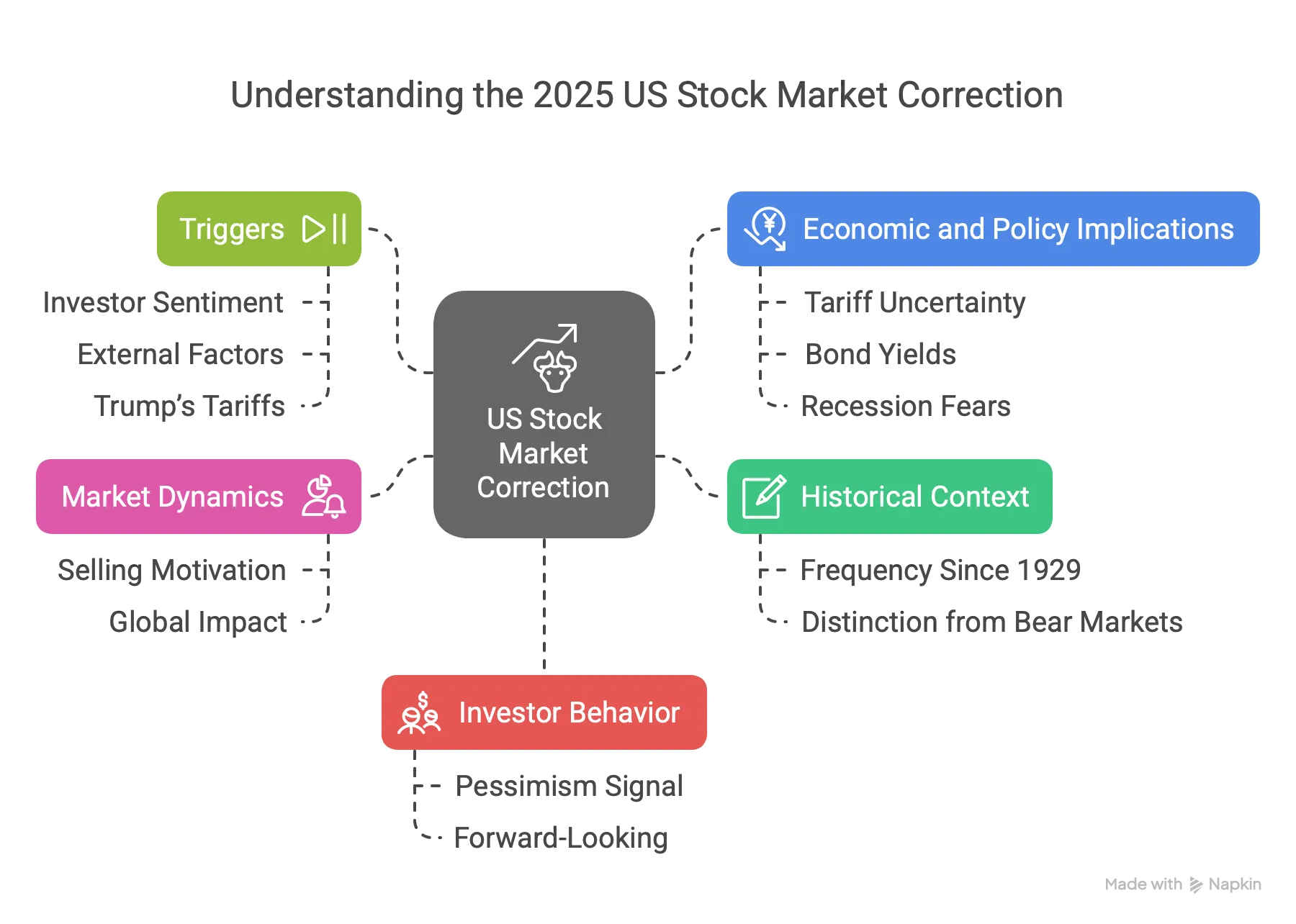

The US stock market’s recent correction, as detailed in an article from The Indian Express dated April 5, 2025, reflects broader economic dynamics with significant implications for global markets, including India. Understanding these shifts is crucial for grasping international economic interdependence, trade policies, and their impact on national economies, a key area of focus for policy and governance studies.

Key Points:

Overview of the Correction

- Event: US stock markets experienced a correction, with the S&P 500 dropping 10.1% from its February 19, 2025 peak by April 4, 2025.

- Definition: A correction is a decline of 10% or more from a recent high, signaling investor pessimism.

Historical Context

- Frequency: Since 1929, the S&P 500 has seen 56 corrections, per Reuters analysis of Yardeni Research data, indicating they are common.

- Distinction: Unlike bear markets (20%+ decline), corrections are shorter and less severe, though bear markets often align with recessions.

Triggers of the Correction

- Investor Sentiment: Shifted due to selling pressure outweighing buying, driven by economic slowdown fears or perceptions of overvalued stocks.

- External Factors: Non-economic events like wars or oil supply shocks can also trigger corrections, though not specified here.

- Trump’s Tariffs: Uncertainty over President Trump’s tariff policies, initially seen as negotiation tactics, now raises economic risk concerns.

Market Dynamics

- Selling Motivation: Investors sell when anticipating lower future returns, influenced by economic slowdown signals or high valuations.

- Global Impact: The correction jolted markets worldwide, reflecting the US’s economic influence.

Specific Market Movements

- April 4 Decline: All major US indexes fell 5% or more, marking the worst single-day drop since 2020.

- Tech Sector: High-valuation tech stocks were hit hardest as investors shifted toward bonds amid rising borrowing costs.

Economic and Policy Implications

- Tariff Uncertainty: Lack of clarity on which tariffs will be imposed fuels market volatility and economic uncertainty.

- Bond Yields: Rising yields make bonds more attractive, pulling investment from stocks, especially tech.

- Recession Fears: Corrections don’t always predict recessions, but prolonged declines could signal broader economic trouble.

Investor Behavior

- Pessimism Signal: The 10% threshold, though arbitrary, marks a psychological shift in investor confidence.

- Forward-Looking: Investors assess future value based on news, rumors, and economic indicators, driving market movements.

Glossary

- Correction: A stock market decline of 10% or more from its recent peak, indicating investor caution.

- Bear Market: A sustained stock market drop of 20% or more, often tied to economic recessions.

- S&P 500: A key US stock index tracking 500 large companies, reflecting market health.

- Tariffs: Taxes on imported goods, influencing trade and economic stability.

- Bond Yields: Returns on government bonds, competing with stocks for investment.

- Tech Stocks: Shares of technology companies, often volatile due to high valuations.

- Recession: A significant economic downturn, typically with two quarters of negative growth.

Link To The Original Article – https://indianexpress.com/article/explained/explained-economics/us-stock-market-correction-9926904/